- Senior citizen Term Insurance

- Know its Eligibility

- List of Senior citizen Term Insurance

I am a passionate content writer with over three years of experience in the insurance domain. An avid learner, I always tries stays ahead of the industry's trends, ensuring my writing remains fresh and includes the latest insurance shifts. Through my work, I strive to engage with targeted insurance readers.

Reviewed By:

Sharan Gurve has spent over 9 years in the insurance and finance industries to gather end-to-end knowledge in health and term insurance. His in-house skill development programs and interactive workshops have worked wonders in our B2C domain.

Updated on Jul 09, 2025 3 min read

Term Life Insurance Plans for Senior Citizens

Experts say buying a term insurance plan at a young age maximizes policyholder security for the future at low premiums. But people these days are caught up in life’s ups & downs and miss out on getting a term insurance plan. Undoubtedly, it is not considered a wise move to secure your future. However, the term insurance eligibility age limit may vary from insurer to insurer, typically between 18 and 65 years. Whether you wish to secure your post-retirement needs or secure elderly parents to ensure financial protection, it is possible with term insurance plans. Keep reading to learn more about the importance of term insurance plans for senior citizens.

Importance of Buying Term Life Insurance for Senior Citizens

Term Insurance is an essential life insurance product to secure the lives of your loved ones financially in your absence. The term insurance plans for senior citizen are designed to provide comprehensive coverage, considering their needs. So, we’ve listed why one should buy term insurance for senior citizens.

Financial Protection

When it comes to securing the family’s future financially, getting a term insurance plan is one of the best ways. With a term insurance plan, you’ve saved enough funds to ensure your loved ones fulfill their daily needs in your absence.

Flexible Payout Options

Term plans offer the flexibility to policyholders of payout options based on their needs. A term plan has four payout options: best payout, lump-sum, staggered, and fixed monthly payout options. You can choose the option that best fits your needs and requirements.

Whole Life Cover

As per the name, a whole life insurance plan provides coverage for the rest of your life and removes the stress of renewing an existing policy. However, it includes coverage for up to 99 years. It is an ideal option for those looking for lifelong protection plans—if they dare to keep up with the premium payments.

Income Replacement

As we know, term insurance plans provide financial protection that can be used as an income replacement. It ensures that the beneficiary has a pre-decided amount of the sum insured for a predetermined period. However, the insured person chooses the pre-decided amount of the sum insured when purchasing the insurance cover.

Features of Term Life Insurance for Senior Citizens

Income Tax Benefits

Under Section 80C of the Income Tax Act of 1961, insurers can avail of income tax benefits and maximize their tax savings. When you buy a term insurance plan, you’re allowed to opt for claim deductions of up to INR 1,50,000 annually for the premium paid towards the upkeep of your life insurance policy.

Premium Rate

Buying a term insurance plan at a young age is considered the best option due to the low premium rate. But if a person buys a term plan over a certain age, they will likely have to pay a higher premium amount. However, the premium may vary from insurer to insurer.

Medical Test

While buying term insurance for senior citizens, you must take a medical checkup. So, the insurer can ensure the policyholder’s fitness and overall health, and enable the insurer to fix premiums and issue policies. Opting for a plan that includes medical tests before purchase is always advisable. Because term insurance plans that do not provide medical checkups prior to issuing the policy give lower coverage.

Optional Riders

Riders are an extra add-on perk that can be added to the basic insurance policy. The insurer offers flexibility to the policyholders, allowing senior citizens to customize plans as per their requirements to increase the plan coverage. However, the rider cost may vary from insurer to insurer.

Types of Term Insurance Plans Available for NRIs

There are various term insurance plans that an NRI can consider buying as per their requirements. Let’s understand them in detail.

Level Term Insurance

This is one of the most common types of term insurance plans, whose sum assured remains the same throughout the policy tenure.

Increasing Term Insurance

This is one of the most common types of term insurance plans, whose sum assured increases after particular intervals or time period.

Decreasing Term Insurance

The coverage amount decreases after a certain time. This type of term plan is often used for mortgage protection.

Term Insurance with Return of Premium

This type of term insurance returns the policyholder’s premiums if they survive the policy tenure.

Convertible Term Insurance

This type of term insurance allows you to convert your plan into a permanent term insurance or whole life insurance.

Whole Life Insurance

This type of term insurance provides you coverage for whole life, ideally up to 99 or 100 years of age.

How to Choose the Best Term Life Insurance Plan for Senior Citizens?

Buying term life insurance for senior citizens is possible, but choosing the right one that best fits your budget can be a hassle. Here, we’ve discussed things that one needs to consider while selecting the best term insurance plan for senior citizens in India:

When it comes to purchasing a term plan, the buyer must consider the future financial needs of their loved ones. To estimate enough funds for your family, you may consider factors such as the family’s budget, debts, inflation, and income replacement that might occur in your absence.

Remember that your premium increases with age to cover unforeseen circumstances due to health conditions and illnesses. Although term plans for senior citizens provide higher coverage help policyholders protect their families without the concern of financial hardship.

While selecting the term insurance plan for senior citizens, the policyholders should also consider any add-on covers offered. It might cost you extra, but it indeed enhances your term insurance’s base cover. Add-on riders include lump sum payout of terminal illness, return of premium on survival, additional coverage on accidental death, etc.

Best Term Life Insurance Companies in India

Indeed, buying term insurance is the best way to secure your family in your absence. To make your selection easier for the best term insurance companies, we’ve listed 23 IRDAI-approved term insurance providers; check and compare plans briefly before purchasing a term plan.

How Will Buying Term Insurance After 60 Affect My Premium?

We all know that Term Insurance is a pure Death Benefit policy that provides Life Cover to the Insured against the risks of sudden or untimely death during the policy term. Generally, the Insurance Company covers an individual up to the age of 75, 85 or 99(whole-life) years.

One is eligible to buy Term Insurance till the age of 65*. However, buying a Term policy at the latter stages of life/ high age will result in higher premiums. With increasing age, there is a higher chance that your health might decline, which may result in certain illnesses. This effectively means that a Senior Citizen is more prone to catching major ailments, which could result in death.

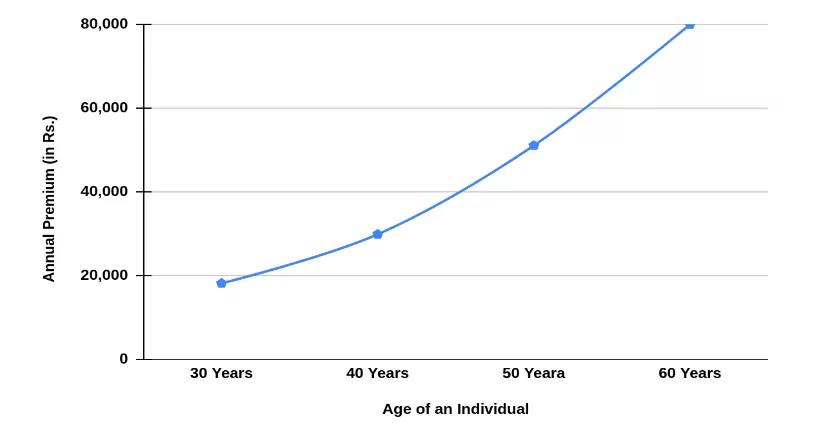

For a better understanding, we have compared the premiums of the ICICI Prudential iProtect Smart Term Plan (whole life cover up to 99 years) for a cover amount of Rs. 50 Lakhs at different ages. Take a look:

| Age | Monthly Premium (in Rs.) | Annual Premium (in Rs.) |

| 30 Years | 1552 | 18,160 |

| 40 Years | 2551 | 29,869 |

| 50 Years | 4361 | 51,073 |

| 60 Years | 6,828 | 79,963 |

Take a look at the graph below to get an idea of how the premium increases with increasing age:

Graph Illustrating Rise in Premium with Increasing Age

With the help of the above-mentioned table & graph, you can analyze that premiums increase with an increase in age.

Riders in Term Life Insurance Plan for Senior Citizens

Term insurance riders provide flexibility to the policyholders to enhance their base cover. Here, we’ve listed the riders available with term insurance plans for senior citizens in India:

Accidental Death Benefit

An accidental death benefit rider is an add-on feature that senior citizens must consider adding to their term life or whole life insurance policy. It offers your dependents additional coverage or death benefits in case of your demise.

Terminal Illness Benefits

Terminal Illness rider, often referred to as an accelerated death benefit rider. It is a life insurance policy rider that gives policyholders access to death benefits before their demise if they’re diagnosed with a severe illness.

Accidental Total Permanent Disability

The accidental total and permanent disability rider is one of the best add-on riders that provide financial protection to the insured person in case of a total and permanent disability due to an accident.

Critical Illness Benefits

A critical illness rider provides financial coverage if an insured person is diagnosed with a critical illness throughout the policy term. Critical conditions include cancer, stroke, kidney failure, and others.

Waiver of Premium Benefits

The Waiver of Premium rider is an optional feature that waives insurance premiums in case the insured person becomes critically ill or physically impaired. However, to add this option feature, you might need to meet certain age and health requirements.

Conclusion

As mentioned above, the premium rate of a term plan increases with age, and age-related illnesses also increase further the older you get. So, buying a term insurance plan for senior citizens to secure a life in the long run is beneficial. Even a backup plan for securing future financial responsibilities in this fast-paced world is a wise option.

If you are confused about which senior citizen term insurance is best, you can visit PolicyX.com or call us at 1800-420-0269. We offer No Spam, No Gimmicks, and Only Expert Insurance Advice.

Term Life Insurance for Senior Citizens :FAQs

1. Should senior citizens buy term insurance plans early?

According to experts, buying a term insurance plan at a young age maximizes policyholder security for the future at low premiums.

2. What is the maximum age limit for term insurance?

The term insurance eligibility age limit may vary from insurer to insurer, generally between 18 and 65 years.

3. Can I buy term insurance for my mother?

Yes, you can easily buy term insurance for your family. It is the best gift you can give your mother, and an insurance plan will keep your mother& 039;s future secure and fulfill all her financial requirements.

4. Can I get term life insurance at age 70?

Yes, senior citizens above the age of 60 can purchase a term insurance plan, but it& 039;s always advisable to buy one at an early age.

5. Can a retired person get term insurance?

Yes, you can avail of a term insurance plan at the age of 60, but if you are retired, then you are not eligible to get term insurance.

6. Is a medical test required for term insurance?

It may vary from insurer to insurer, but it is always advisable to opt for a plan that includes medical tests before purchase.

7. Can we take term insurance without a job?

Generally, to buy a term insurance plan, policyholders must provide proof of income to the insurer.

8. Who will pay for term insurance medical test?

The insurance company pays the buyer complete medical checkup when applying for a term plan.

9. What is the best term life insurance for seniors?

Axis Max Smart Term Plan Plus is one of the best term insurance plans for senior citizens.

10. Which insurance company is best for senior citizens?

There are various companies that are good for buying senior citizen term insurance such as Axis Max Life, SBI Life, LIC, etc.

Other Term Insurance Companies

Share your Valuable Feedback

4.6

Rated by 868 customers

Was the Information Helpful?

Select Your Rating

We would like to hear from you

Let us know about your experience or any feedback that might help us serve you better in future.

Written By: Varun Saxena

I am a passionate content writer with over three years of experience in the insurance domain. An avid learner, I always tries stays ahead of the industry's trends, ensuring my writing remains fresh and includes the latest insurance shifts. Through my work, I strive to engage with targeted insurance readers.

4430-1740390818.webp)

4391-1741255269.png)

Do you have any thoughts you’d like to share?